By:

Links to sections (tap to open)

It’s Not All About Rent

Low lot rent (or land rent, or space rent) is just one of the many ways to save on the costs of living in a mobile home in a park. To save money on mobile home park costs, you need to know the major costs. Mobile home parks have hidden costs that do not exist in apartments or site-built houses, but do you know about those costs?

With good information, mobile home park residents and home buyers can save time, money and reduce anxiety while raising prosperity. Here we explore the major costs that affect mobile home park living—so you can shop for the best long-term security.

What Is the Lowest Cost Mobile Home Park?

Using low rent prices alone may be a bad way to choose where to buy a mobile home in a park. There can be surprising expenses beyond rent, or surprises imposed upon you after you have settled into your mobile home. If you don’t know before you buy, it may be too late to get out of the situation without losing money. You may be able to lower your risk and your expenses by learning more about mobile home parks.

A mobile home purchase, in a for-profit park, is not like a consumer shopping experience. It is not just a matter of finding the nicest home at the nicest price with rent that looks good.

Think Long-Term—3 to 5 Years or Longer

You should slow down; learn the details about what you are committing to for the long-term. When you buy other expensive items, such as a car, a condominium or site-built home, you can more easily estimate your future, but not so much with houses where you rent the land. Important parts of your future are not as visible, not under your control and may not be disclosed to you in a timely manner.

Remember: In most for-profit mobile home parks where you rent the land, you have the rent cost plus 6 additional costs to consider.

1. The Cost of Buying the Home Itself

You may get a loan or a mortgage to be able to buy the home, but your monthly mortgage payment is in addition to monthly rent on the land. If you buy the entire home with cash that you have saved, you still have the additional monthly land rent cost. Some parks own the homes in them and rent the entire home and land together, so you do not have to buy the home to live in those rare parks. But most parks require you to buy the home and then agree to rent the land underneath.

2. The Monthly Rent for the Land (Lot) and Park Amenities

Unlike the mortgage payment, it is possible for the land rent to go higher, much higher, during your stay. Sometimes this is associated with the sale of a park to a new landlord that is intent on jacking up rent levels. This can greatly affect your housing and financial security depending on how high the rent is raised. Sometimes a seller or agent will offer special deals or discounts on rent for the first few years but you need to know in writing what the rent will be after the “deal” ends. What will you have to pay in 3 years, 5 years and beyond?

Large rent hikes can happen in mobile home parks, especially after a mom-and-pop owner sells the park to a large rent-gouging corporation. Beware agreeing to low move-in deals until you have an idea about the risk level of the park. Just a few years after you move in, you could find costs skyrocketing, depending on how the park is managed. If that happens, can you afford to stay? Will you have to sell your home at a significant loss?

Beware of Compounding Rent Increases—Larger Raises Each Year

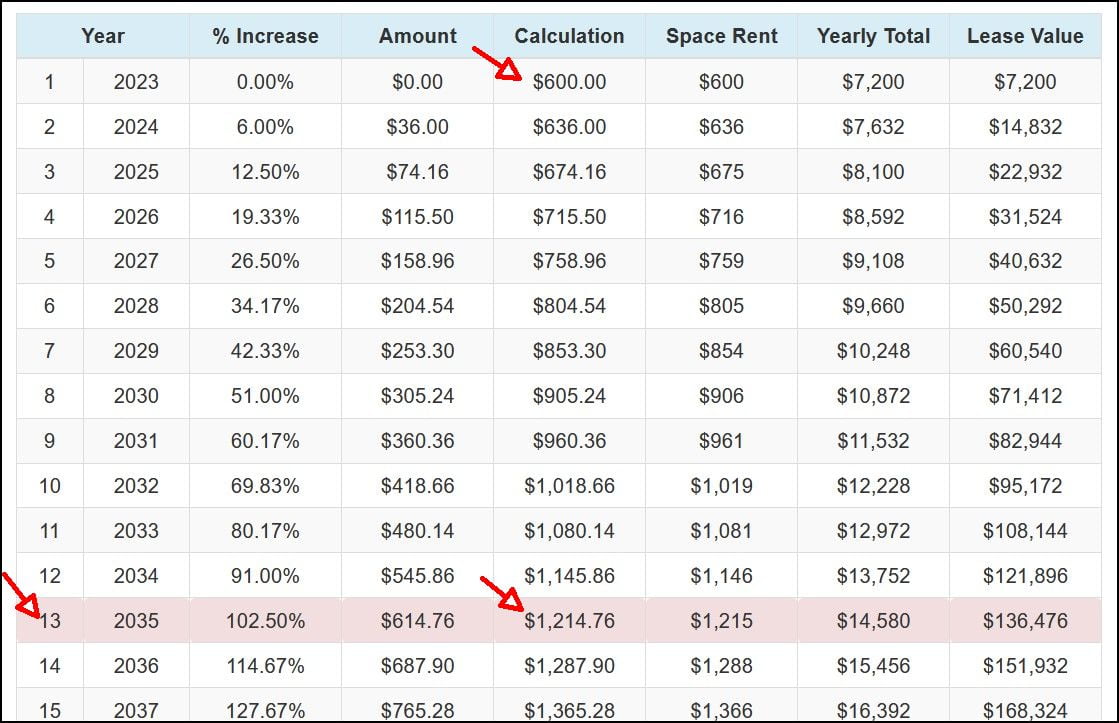

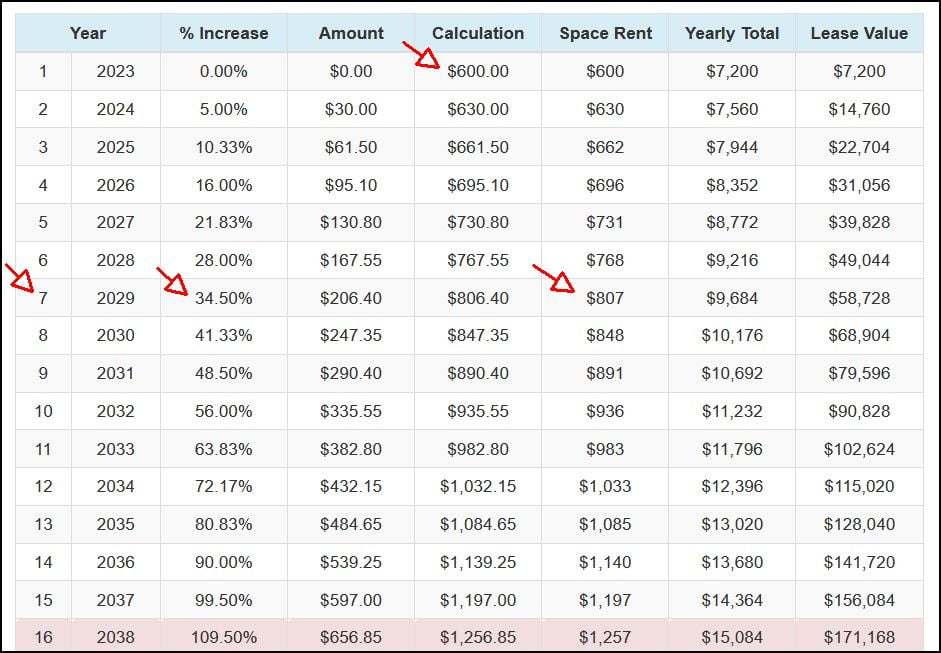

Don’t be fooled by what looks like a small rent increase—it may be compounding! That means that each year the increase is larger than last year’s. What may look like a small rent increase, such as a 6% annually, can result in the rent doubling in 13 years! Similarly, a 5% annual rent increase can increase rent by 1/3 in 7 years. Can you do the math? Can you still afford it? At what year will it become too much? Find out what the future rent will be with a rent calculator.

Details: A 6% Annual Compounded Rent Calculation Doubles Rent in 13 Years (tap to open)

A 600 dollar a month rent at 6% annual compound results in rent having doubled by 13 years

(credit: MHPHOA.com)

Tap to enlarge

Details: A 5% Annual Compounded Rent Rises to 1/3 Greater in 7 Years (tap to open)

A 5% Annual Compounded Rent Increase Results in Rent 1/3 Higher in 7 Years. e.g. a $600.00 rent grows to $800.00

(credit: MHPHOA.com)

Tap to enlarge

Experts warn about compounding rent increases. If you cannot get firm written numbers about future rent increases from your landlord, then how safe is the park? If you get cloudy answers and nothing in writing, beware! Your investment in your immovable house may be your largest purchase, but it is tied to the landlord’s property and he can change his decisions about what to charge. And as rents rise, your house’s value may fall.

To protect your major investment and finances, you may need more assurances about the future. Too many homeowners report that they did not fully understand the risks before they made a major purchase.

3. The Monthly Utility Bill

Some utilities may be included in your monthly rent but some may be billed directly from the utility company. Ask the park office for details. In some situations, utility costs are considered part of rent and if you don’t pay them with rent, you may be on the road to eviction.

That can mean if there is a mistaken overcharge on the utility bill from the park owner, you cannot withhold the excess charge or you will be considered late on rent and that could lead to eviction from the park! You may have to pay the overcharge anyway and plead for a refund, which can take weeks or months in some parks. If you cannot afford the mistaken charges, you may need to seek outside legal help. The outcome may depend upon whether the park owner agrees in writing that there is a mistake.

4. It costs to maintain a Mobile Home and Lot

In many parks you will be required to maintain your home and rental lot at your own expense. The cost of this maintenance varies depending on the condition of the home and rental lot. Failure to maintain your home and lot could start you on a path to eviction.

Some park managers periodically survey the homes and lots for signs of deterioration. They may require the homeowner to make repairs—at the homeowner’s expense. This requirement may be spelled out in the written Rules and Regulations of the park (R&Rs) or in the CC&Rs of the park.

If you are accustomed to living in apartments, you probably don’t have the habit of inspecting your house for deterioration, nor have the skills, tools and time to perform repairs. Homeowners need to learn how to inspect their house and prevent problems before they grow expensive. If too much of your income is being spent on rent, you may not be able to afford proper home maintenance. Here are some preventative tips for everyone. Also, for example, California’s Department of Housing and Community Development (HCD) has some minimum requirements explained here.

Mobile home owners should find out if they are required to make expensive repairs and if they can be evicted for delaying repairs for too long. A professional house inspector may help to spot issues with the home that inexperienced newbies may overlook. Ex-apartment dwellers need to realize that they should keep a reserve of cash for home and lot repairs.

5. The Unseen Cost of Home Depreciation

If rents keep rising, when you decide to move out of the park, you may find you cannot sell the home for as high a price as you bought it. Some of the money you paid to buy the home may not be recovered. Keep in mind that the appreciation of regular site-built “homes” is often due to land appreciation and less due to the house itself. Generally, mobile home owners in parks do not own land and cannot benefit directly from land value appreciation. There is no perfect formula to predict mobile home devaluation, but experts agree it occurs. If the housing market is tight, then mobile homeowners may experience better home values.

If the mortgage and rent are low, it may be worth it to take a financial loss on sale of the home because over the long-term the savings and benefits were preferable to apartments. In some situations you can financially break even on the sale of a mobile home or even make a profit. But achieving those goals may require tricky math calculations, careful home selection, speculative timing, and luck—too much to depend upon.

6. The Non-Financial Emotional Costs

The risks of living in some mobile home parks may be a source of emotional stress when the homeowners begin to perceive that the park is riskier than they expected. If there are no rent protections and the park is still family-owned, there is the possibility that it may be sold to a large corporate aggregator that has a history of raising rents.

Or the current park owner, after watching other landlords raise rents, will decide to increase his profits too by raising the rental bill. This potential for change makes reliable financial planning impossible. When that happens, feelings of financial security and stability may be lost. Less security can mean more emotional stress upon homeowners and medical science has shown that housing stress can create health risks.

7. The Extra Time and Attention Needed to Safeguard Your Housing Security

Mobile home owners may have to devote time to protecting their investment—something that is less necessary and easier with other types of investments. These outlays include organizing homeowners, learning the complexities of mobile home park living and staying committed.

Even if homeowners are successful at getting reliable assurances, they must exert some ongoing effort to stay watchful and maintain those protections over the long-term. When obsolete laws are applied to this new form of housing, the homeowners are less protected and must compensate with their own additional vigilance.

However, It’s not a loss to be involved in government and connected to society. In a democracy, citizens have a civic duty to be engaged and promote prosperity. It’s not a bad thing to be involved in politics and protect America. Homeowners discover that being active and connected to their community is empowering and transformative—giving more depth and meaning to their lives.

Summary: Mobile Home Parks Can Change Rapidly These Days, Be Prepared

In parks run by good-citizen, community-minded park owners, (often families of the founders), the homeowners tend to feel more secure and less aware or concerned about these 7 costs. But, unless they have an agreement to purchase the park for themselves when it is sold, they may join the ranks of many, many mobile home owners in parks across the nation where profiteers took over the park and affordable housing security fell dramatically. It is better to be prepared than to be surprised and dismayed.

Other safety measures include rent stabilization and nonprofit ownership, to be covered in Part 3 and Part 4.

A quick introduction to the financial risk level of various kinds of mobile home parks.

To save money and energy living in a mobile home park, you need to know all the costs. Do you?

The conditions you submit to when living in a mobile home park. They are often unwritten, even invisible.

Shopping for low mobile home park rent? Compare different kinds of parks for their rent levels and security.